Unlock the power of data with our comprehensive suite of solutions designed for industries dependent on chemical products. Whether you're monitoring recent market trends, analyzing historical pricing data, or gaining crucial insights, our platform equips you with the resources needed for informed decision-making.

Our platform offers a comprehensive suite of country insights tailored to meet the strategic needs of businesses operating in the chemical industry. Gain access to a wealth of data on key economic indicators, including inflation rates, GDP growth, interest rates, corporate tax rates, population demographics, minimum wages, ESG rankings, and foreign direct investment. Stay informed about global market trends and regulatory environments to make informed decisions and drive your business forward effectively. With our user-friendly interface and customizable tools, navigating through country-specific data has never been easier. Stay ahead of the curve and unlock valuable insights to enhance your strategic planning processes.

Embark on a journey through country-specific data insights tailored to the chemical industry. Our platform offers a comprehensive array of metrics including inflation rates, GDP, interest rates, corporate tax rates, population statistics, minimum wages, ESG rankings, and foreign direct investment data. Whether you're analyzing economic indicators, regulatory landscapes, or demographic trends, our platform provides the tools you need to make informed decisions and stay ahead of the curve.

Unlock valuable insights into each country's economic performance, regulatory environment, and market potential. Dive deep into the data to understand the nuances of global markets, identify emerging opportunities, and mitigate risks. With our intuitive interface and customizable features, navigating through country-specific data has never been easier. Gain a competitive edge and drive your business forward with our comprehensive country watch solutions.

For those requiring offline analysis or integration into reports, we offer convenient download options. Access and download trade data, charts, and comprehensive reports, enabling further analysis at your convenience. This feature ensures you have the data you need, whenever you need it, in a format that suits your analytical workflows.

"Embrace the full power of our chemical industry portal through our straightforward annual subscription model. Designed to provide continuous, comprehensive access to our invaluable market insights, trade data, and analysis tools, our subscription ensures you have the information you need to make informed decisions all year round. Interested in learning more about our pricing? Contact us today for detailed pricing information and discover how our portal can transform your business insights."

"Not quite ready to commit? We understand the importance of ensuring our portal meets your needs. That's why we offer a no-obligation free trial, giving you the opportunity to explore our features and data depth firsthand. Experience the advantage and confidence our portal brings to your business decision-making process. Sign up today and witness the impact of having the right information at your fingertips."

Yes, our platform allows you to access a comprehensive suite of key economic indicators for each country, including inflation rates, GDP, interest rates, corporate tax rates, population statistics, minimum wages, ESG rankings, and foreign direct investment data.

You can start your free trial or request a demo of our platform by clicking on the respective buttons provided on our website. Our team will be happy to assist you and provide further information on how our comprehensive country watch solutions can benefit your business.

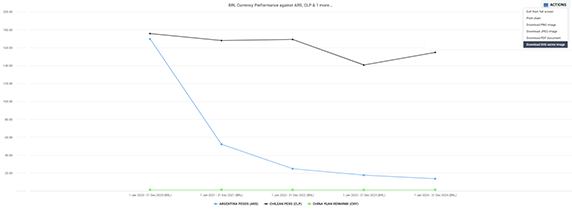

Our platform offers interactive charts, graphs, price comparison tools, and download options tailored to provide comprehensive insights into country-specific data dynamics. These tools enable dynamic exploration of trends, patterns, and fluctuations, empowering more informed decision-making based on real-time and historical data.

Our platform updates country-specific data regularly to ensure you have access to the most up-to-date information for informed decision-making.

Yes, our platform is designed with a user-friendly interface and customizable features to facilitate effortless navigation through country-specific data. Whether you're analyzing economic indicators, regulatory landscapes, or demographic trends, our platform provides intuitive tools to streamline your analysis process.