Our platform offers comprehensive data solutions for industries reliant on chemical products. From tracking market trends to analyzing historical pricing data, we provide insights for informed decision-making. Covering crude oil, inorganic, and organic substances, our platform offers recent, historical, and market insights for each category. Dive into pricing trends for products like Dated Brent, Nymex Crude, and WTI Cushing, or explore chemicals like ammonia, chlorine, benzene, and acetone. With our user-friendly interface, navigating complex data sets is seamless. Stay ahead with our comprehensive data solutions.

Access current prices, historical trends, and forecasted rates for key chemicals with ALCHEMPro. Whether it's raw materials or specialty chemicals, stay ahead with accurate and actionable data to streamline your trade strategies. Our data-driven insights help you anticipate market trends, reduce costs, and maximize profitability.

Our platform offers a robust suite of data solutions tailored to meet the dynamic demands of industries reliant on chemical products. From tracking recent market trends to analyzing historical pricing data and gaining invaluable market insights, our tool equips you with the essential resources needed to make informed decisions. Covering a diverse array of products including crude oil, inorganic, and organic substances, our platform provides access to recent, historical, and market insights for each category. Dive into pricing trends for sub-products such as Dated Brent, Nymex Crude, and WTI Cushing in the crude oil sector, or explore the vast range of inorganic and organic chemicals like ammonia, chlorine, benzene, and acetone. With our user-friendly interface and customizable tools, navigating through complex data sets has never been easier. Stay ahead of the curve and drive your business forward with our comprehensive data solutions.

Dive deep into the chemical industry with our expansive database, offering recent, historical prices, and market insights across a wide spectrum of products. From the foundational crude oil commodities like Dated Brent, Nymex Crude, and WTI Cushing to a vast array of inorganic and organic chemicals, our platform is your one-stop source for up-to-date pricing and market trends.

Our coverage includes but is not limited to essential inorganic chemicals such as ammonia, sulphuric acid, and chlorine, alongside a comprehensive list of organic compounds including acetic acid, benzene, and methanol. With over a hundred sub-products detailed, including chemicals like Titanium Dioxide, Caprolactam, and Vinyl Acetate, our tool provides unparalleled insights into the chemical market dynamics.

Whether you're tracking the price movements of basic building blocks like Ammonium Sulfate and Hydrochloric Acid or navigating the complexities of the organic chemical markets with products like Ethylene Glycol and Phenol, our database supports informed decision-making. This extensive product coverage ensures that industry professionals, researchers, and market analysts have access to the data needed to analyze trends, compare market movements, and strategize with confidence.

Embrace the power of comprehensive market insights and stay ahead in a competitive landscape with our detailed analyses of chemical product trends. Let our platform be your guide to understanding the nuances of the chemical markets, enabling strategic planning and operational excellence.

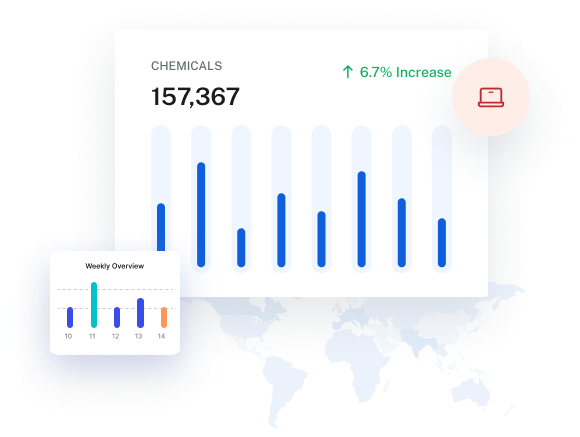

Delve into the intricacies of market dynamics through our interactive charts and graphs. These visual tools offer a dynamic exploration of current and historical price data across all our covered products and sub-products. With easy-to-use interfaces, you can visualize trends, patterns, and fluctuations in the market, enabling more informed decisions based on real-time and historical data.

Navigate the complexities of the chemical market with our advanced price comparison tools. Compare prices across different chemicals, regions, or timeframes to identify opportunities and risks. Whether you're assessing the competitiveness of inorganic chemicals or tracking the price volatility of organic compounds, our comparison tools provide the insights you need to stay ahead.

For those who need to analyze data offline or integrate it into their own reports, we offer convenient download options. Access and download pricing data, charts, and comprehensive reports, allowing you to further analyze market trends at your convenience. This feature ensures that you have the data you need, whenever you need it, in a format that suits your analysis workflows.

"Embrace the full power of our chemical industry portal through our straightforward annual subscription model. Designed to provide continuous, comprehensive access to our invaluable market insights, trade data, and analysis tools, our subscription ensures you have the information you need to make informed decisions all year round. Interested in learning more about our pricing? Contact us today for detailed pricing information and discover how our portal can transform your business insights."

"Not quite ready to commit? We understand the importance of ensuring our portal meets your needs. That's why we offer a no-obligation free trial, giving you the opportunity to explore our features and data depth firsthand. Experience the advantage and confidence our portal brings to your business decision-making process. Sign up today and witness the impact of having the right information at your fingertips."

Our platform updates current prices in real-time to ensure you have access to the most up-to-date market data.

Yes, our platform offers historical pricing data spanning over a significant period, allowing you to analyze past market trends and patterns.

Our platform offers comprehensive market insights covering a wide spectrum of products, including crude oil, inorganic, and organic substances. You can explore pricing trends, market dynamics, and more to inform your decision-making process.

To start your free trial or request a demo of our platform, simply click on the respective buttons provided on the page. Our team will be happy to assist you and provide you with the necessary information.

Yes, we offer a suite of interactive tools, including interactive charts and graphs, price comparison tools, and download options. These tools are designed to enhance your market analysis experience and provide you with comprehensive insights into pricing trends and market dynamics.